[ad_1]

Key Takeaways

- CME has seen a dramatic increase in open interest, reaching $3.58 billion and securing the second spot in the Bitcoin futures market.

- Standard Bitcoin futures contracts have primarily driven the spike in CME’s open interest, implying increased institutional involvement.

- CME’s open interest trends align with Bitcoin’s recent price surge, emphasizing the bullish sentiment in the cryptocurrency market.

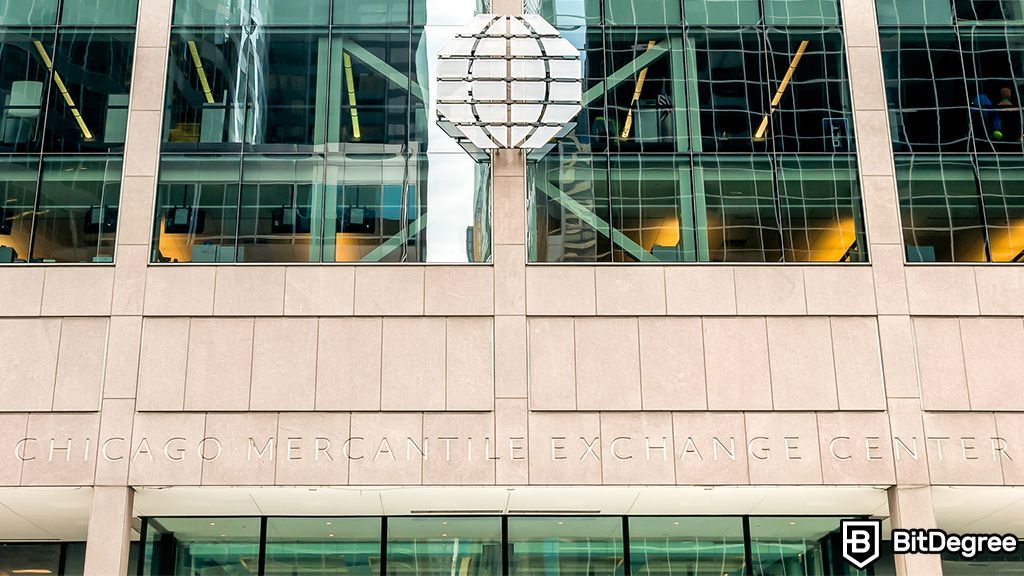

The Chicago Mercantile Exchange (CME) has recently jumped to second place in the Bitcoin futures market rankings, trailing only Binance.

A noticeable surge in open interest has propelled CME to overtake competitors Bybit and OKX in the Bitcoin futures market.

Did you know?

Want to get smarter & wealthier with crypto?

Subscribe – We publish new crypto explainer videos every week!

As of October 30th, CME’s open interest reached a significant $3.58 billion, just slightly below Binance’s $3.9 billion. In the preceding week, CME’s ranking improved by two positions. For context, Bybit and OKX had open interests of $2.6 billion and $1.78 billion, respectively.

The trading vehicles contributing to this surge primarily involve CME’s standard Bitcoin futures contracts, which are valued at five Bitcoins each. On the other hand, their micro contracts are valued at one-tenth of a Bitcoin.

In offshore exchanges, the focus tends to be on perpetual futures, which have no set expiration date and rely on the funding rate to keep prices aligned with market rates.

Open interest in Bitcoin refers to the total value of unexecuted Bitcoin futures or options contracts in the market. An increase in this metric implies more capital flow into Bitcoin futures, often taken as a bullish market indicator. Conversely, a decline points to bearish sentiment.

The rise in CME’s open interest is significant for several reasons. It’s not just an indication of its second-place ranking but also represents a high trading volume of its cash-settled futures contracts, exceeding 100,000 BTC.

The exchange now holds a market share of 25% in Bitcoin futures, driven largely by standard futures contracts. This uptick suggests a growing institutional interest, particularly as Bitcoin experienced a robust double-digit increase in October, briefly pushing its value over a one-year high of $35,000.

The swift rise in open interest at CME is not only a bullish indicator for the Bitcoin market but also signals the exchange’s growing influence in the crypto futures landscape. The increased institutional participation further highlights the mainstream acceptance of Bitcoin as a legitimate investment vehicle.

Gile is a Market Sentiment Analyst who understands what public events may form what emotions. Her experience researching Web3 news and public market messages – including cryptocurrency news reports, PRs, and social network streams – is critical to her role in helping lead the Crypto News Editorial Team.

As an intelligent professional in public relations, together with the team, she aims to determine real VS fake news patterns, and bring her findings to anyone searching for unbiased news and events happening in the FinTech markets. Her expertise is uncovering the latest trustworthy & informative Web3 announcements to the masses.

When she’s not researching the trustworthiness of mainstream stories, she spends time enjoying her terrace view and taking meticulous care of her outdoor environment.

[ad_2]

Source link